Tesla Is Priced for Perfection but Growth Worries Make It a Hold

Why Tesla Is Stuck in the Middle

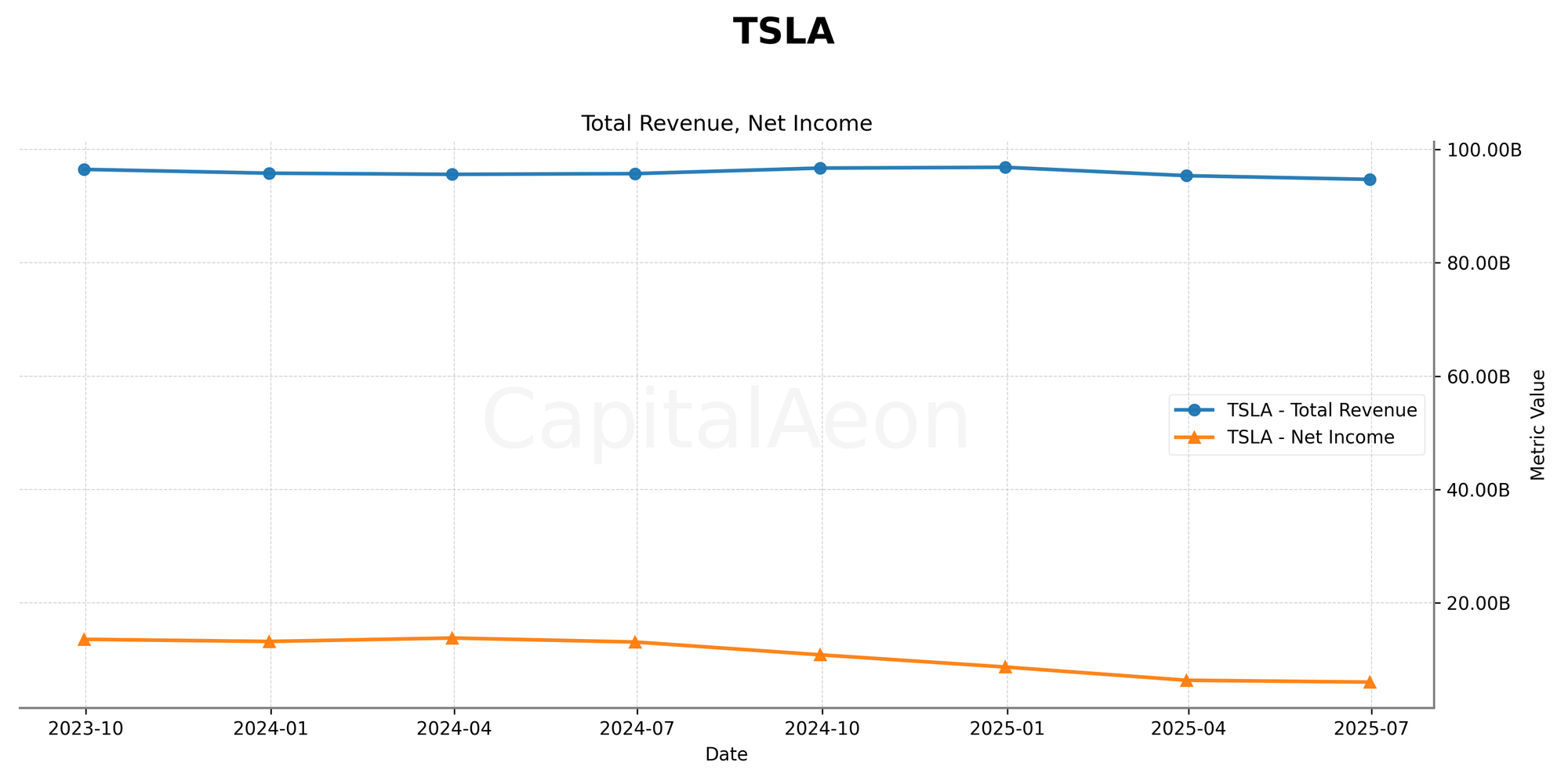

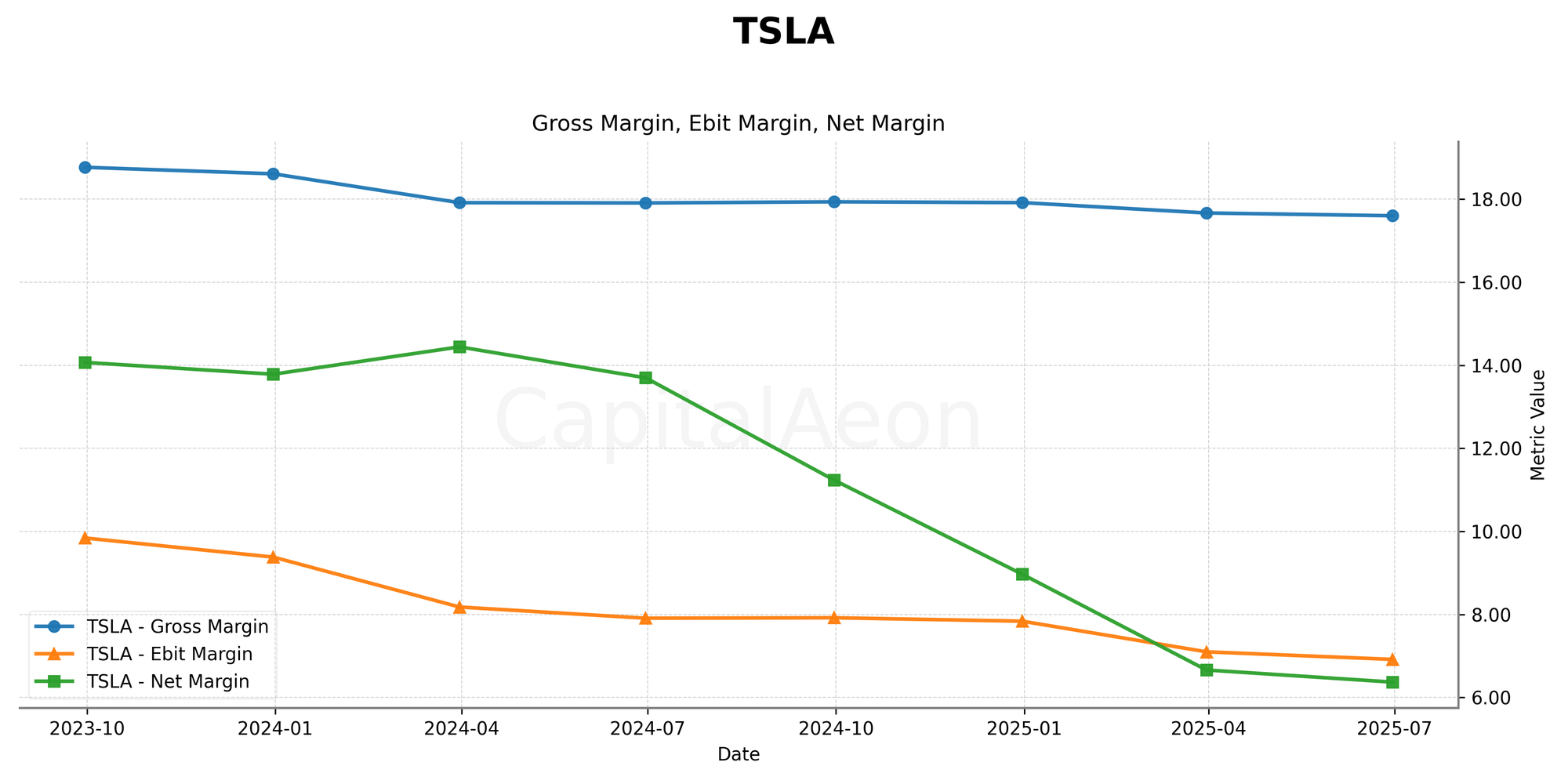

Tesla (NASDAQ:TSLA) is in a strange position right now. The company is still pushing bold ideas about self-driving, energy storage, and AI, but the actual numbers from recent quarters are heading in the wrong direction. In the second quarter of 2025, revenue dropped 12 percent from last year and profit slipped 16 percent. Margins are getting squeezed by lower automotive revenue and gross margin, fewer regulatory credits, and a rising warranty bill that now stands at $7.5 billion.

On the bright side, Tesla has a lot of financial firepower, holding $36 billion in cash. It has $3.75 billion in deferred revenue tied to Full Self-Driving software and more than $10 billion in future obligations for energy storage products, both of which point to real growth opportunities.

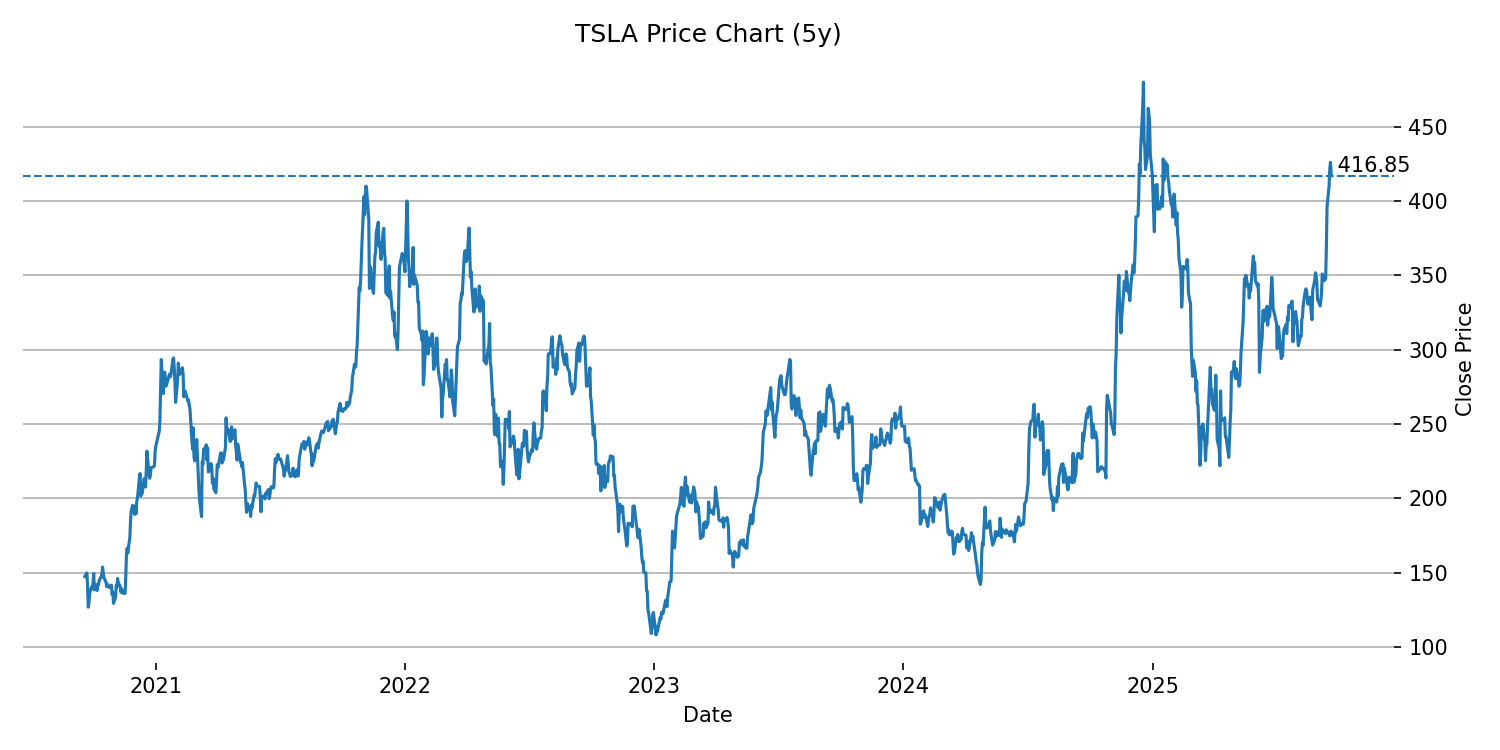

The challenge is the stock price. At about $422, shares trade at 249 times forward earnings and 14 times sales. That price tag assumes the future plays out almost perfectly. The market is excited about Musk’s $1 billion insider buy and the long-term promise of autonomy, while brushing off concerns such as safety probes into door handles and weaker U.S. market share.

In my view, the stock sits in a middle ground. There could be upside if Tesla’s software or energy bets start to deliver faster than expected, but there is just as much downside if competition and regulation keep eating away at the car business. At the current valuation, I do not see a reason to buy more, but I also do not see enough weakness to sell. For me, Tesla is a Hold.

What Tesla Is Building

Tesla still gets most of its revenue from cars. Out of $41.8 billion in sales during the first half of the year, about $30.6 billion came from vehicles. The energy business is smaller but gaining ground, bringing in $5.5 billion in the same period, which was up 19 percent compared to last year.

Management has been putting money into three big areas. First, they are investing heavily in AI, with $6.2 billion in AI-related infrastructure on the balance sheet compared to $5.1 billion a year earlier. Second, they are expanding their global manufacturing footprint, boosting output at the German Gigafactory and pushing forward with another $7.7 billion in construction projects. Third, the energy backlog worth $10.4 billion signals that solar and storage could become a much larger business.

The vision is clear: make each car a platform that can generate recurring income from FSD, insurance, and software upgrades, while also turning Tesla into a leader in clean energy. The trouble is execution. EV sales are declining in Europe, U.S. share is slipping, and subsidies that once gave Tesla a cushion are starting to shrink. The strategy is bold, but the near-term results are uneven.

Where Tesla Stands in the EV Race

The EV market is changing, and the easy growth years may be over. Tax credits in the U.S. are starting to fade. Competition from global automakers is intensifying, while startups such as Rivian and Amazon’s Zoox are finding ways to scale. Tesla’s market share in the U.S. has fallen to an eight-year low, a sign that the company no longer dominates as it once did.

The bigger picture still works in Tesla’s favor. EV adoption continues to climb worldwide, demand for energy storage is rising, and autonomous driving could one day open up a whole new source of revenue. Investors increasingly think of Tesla less like a carmaker and more like a mix of Apple and Nvidia, with both ecosystem and AI qualities.

Even so, the fight is getting harder. Detroit automakers benefit from regulatory changes, and Chinese firms are cutting prices aggressively. The stock price reflects an assumption that Tesla wins on all fronts, which is a tall order.

The Numbers Tell a Different Story

The numbers tell a mixed story. In Q2 2025, revenue fell to $22.5 billion, which was down 12 percent from a year ago. Net income dropped 16 percent to $1.17 billion. Gross margin fell to 17.5 percent. Operating margin shrank to about 3.2 percent in the first half of 2025.

The cash position remains strong at $36.8 billion compared with $13.1 billion in debt, but free cash flow has been under pressure, falling nearly 250 percent year-over-year due to higher spending and swings in working capital.

Automotive revenue is falling as price cuts bite into sales. The energy side is improving, up 19 percent in the first half, and services like insurance and repairs are becoming more meaningful, with $3 billion in revenue during the second quarter. In short, Tesla is moving from a story of high margins and rapid growth to one of lower margins and slower progress.

Priced for Perfection

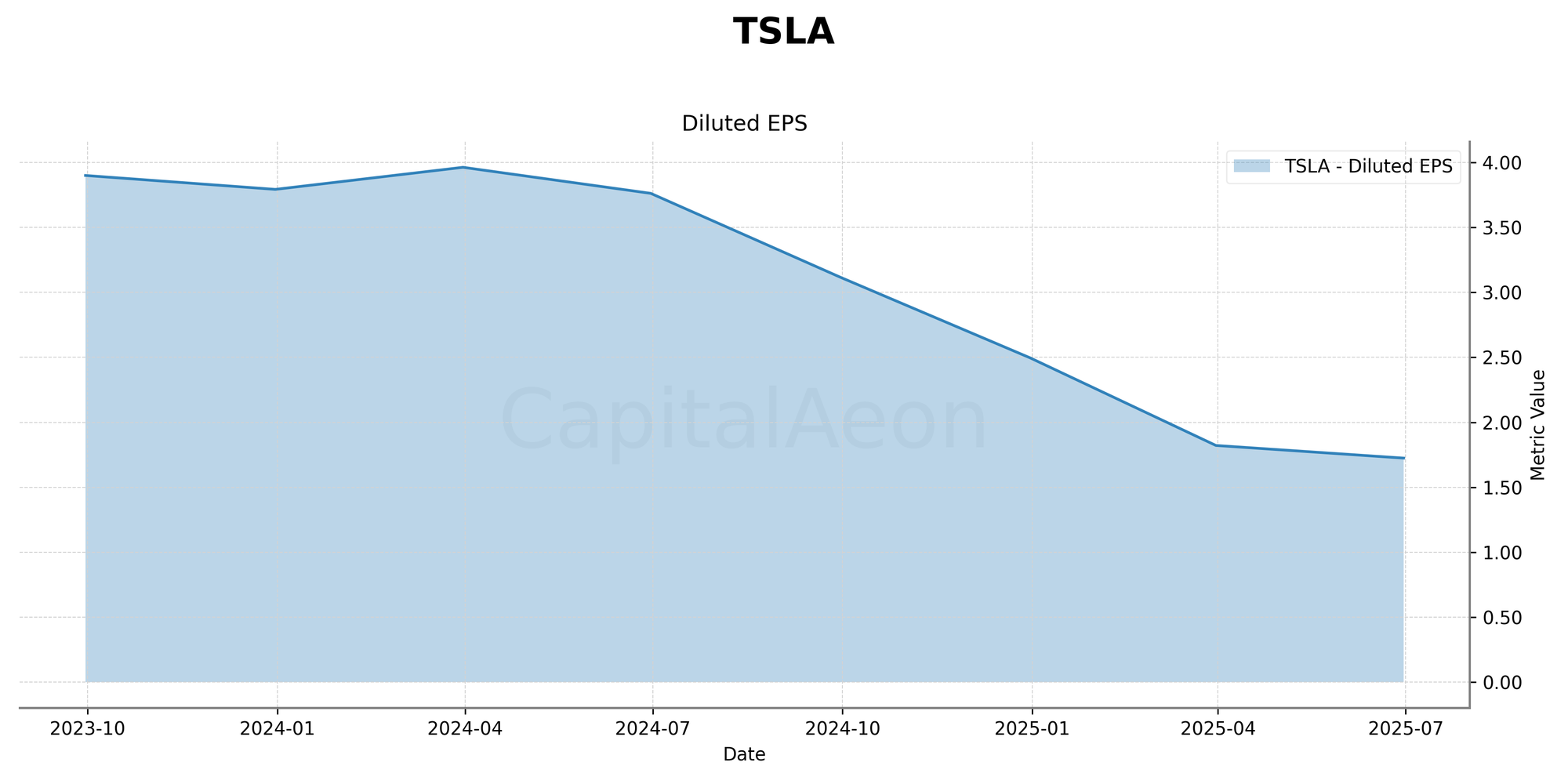

At today’s price, Tesla trades at valuation levels that are hard to justify. The shares are valued at about 249 times forward earnings, 14.5 times sales, and 118 times EBITDA. Analysts expect Tesla’s earnings per share to grow from $1.76 in 2025 to $3.23 in 2027, which would mean growth of roughly 35 percent each year.

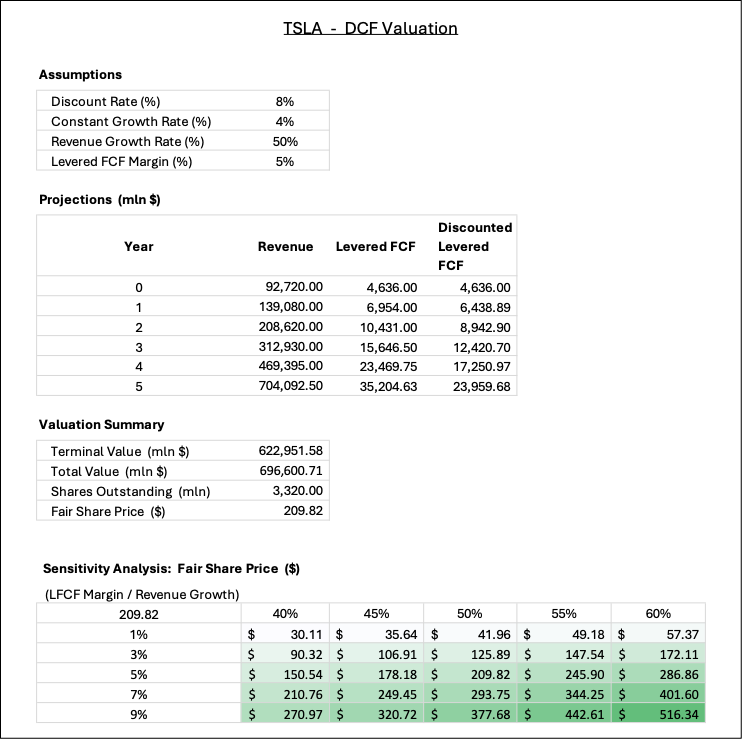

Even then, the stock would be trading at around 130 times those future earnings. Investors are paying for the possibility that Tesla will succeed with autonomy, energy, and brand expansion, but those are still promises rather than realities. A discounted cash flow analysis using optimistic inputs, including 50 percent revenue growth and a 5 percent free cash flow margin, yields a fair value of only about $210 per share, less than half of the current price. This gap highlights how much of Tesla’s future success is already assumed in today’s valuation.

What the Headlines Miss

Recent headlines show both optimism and concern. On the positive side, Musk’s $1 billion insider buy, Wedbush calling him a “wartime” CEO, and the ramp-up in Germany all boosted sentiment. On the negative side, safety probes into door handles, lawsuits tied to fraud, and weakening European sales weighed on the story.

Despite the risks, investors are leaning bullish. The stock is up nearly 86 percent over the past year, even though revenues are down. That signals a market focused more on the narrative than the numbers, which makes the situation fragile if expectations are not met.

What Could Go Wrong

Tesla faces several important risks. Regulatory pressure is rising, with safety probes and lawsuits that could become costly. Warranty obligations are already high at $7.5 billion, and quality problems could add to that. Competition is intense, with U.S. and European share losses underscoring the pressure on its market leadership. On top of that, Musk’s political activity and divided attention raise questions about focus.

These risks are not just operational but also reputational. A major recall or regulatory clampdown could hurt the brand at the same time as the bottom line.

The Road Ahead

Looking ahead, analysts expect Tesla’s revenue to climb from about $93 billion in 2025 to $134 billion in 2027, with earnings growing in the mid-30s percent range each year. The path to that growth is tied to things already in motion. The company has $3.75 billion in deferred Full Self-Driving revenue sitting on its books, which will be recognized once software features are released. It also has an energy backlog of $10.4 billion, reflecting orders for storage systems that only need to be delivered and installed. These figures show that a large part of Tesla’s future depends less on finding demand and more on whether it can execute smoothly.

The spending side of the story is just as important. Tesla currently has $7.7 billion of construction projects underway and $6.2 billion tied up in AI infrastructure. These outlays are meant to expand factories and strengthen the technology behind self-driving. They also drain cash in the short term, which is why free cash flow has slipped so sharply compared with last year. With $36.8 billion in cash and about $7.0 billion of total debt, Tesla can afford to spend heavily, but investors will be looking for signs that these projects quickly translate into higher revenue and better margins.

Cars remain the heart of the business, yet automotive sales are no longer growing the way they used to. In the first half of this year, vehicle revenue dropped from $37.3 billion to $30.6 billion. That decline reflects both pricing pressure and weaker unit volumes. As a result, Tesla’s reliance on other sources of income is increasing. Energy storage grew about 19 percent in the first half, and services like insurance and repair brought in $3 billion last quarter. These areas were once small, but they are starting to matter.

The potential upside is clear. If Tesla can ramp up software adoption, turn its energy backlog into sales at margins that have been improving year over year, and get more out of its global factories like the one in Germany, it could surprise on the upside. The risk is that warranty obligations, already $7.5 billion, keep climbing, while regional incentives decline and competitors continue to pressure Tesla’s share.

In my view, the coming years will be shaped less by new promises and more by how well Tesla delivers on commitments already in place. The company has the resources and backlog to support another growth spurt, but whether it happens depends on execution. If the pieces fall into place, Tesla could move into a stronger second act. If not, the lofty expectations built into today’s share price may be hard to justify.

Possible Paths for the Stock

If things go badly, the stock could sink toward $250. That outcome would likely come from continued market share erosion, costly recalls, and shrinking margins, which would push investors to give Tesla a much lower earnings multiple. If things play out in line with current expectations, the stock might hover between $400 and $450, supported by steady growth in energy, flat car sales, and gradual recognition of deferred FSD revenue. If the company surprises on the upside, Tesla could break above $600, powered by meaningful robotaxi revenue, rapid growth in storage, and stronger margins that convince investors to value the company like a tech leader again.

At today’s level of $422, Tesla is priced somewhere between the base and bull cases, which does not leave much room for error.

My Bottom Line

Tesla is one of the most hotly debated stocks in the market. I do not think it should be sold given its strong balance sheet, powerful brand, and long-term opportunities. I also do not think it should be bought aggressively right now given the high valuation and soft earnings. For me, the middle ground is the right place: Tesla is a Hold.

If you already own it, it makes sense to keep your position but avoid adding more until growth and valuation line up more clearly. If you are on the sidelines, a better entry point would be in the $300 to $350 range, which would provide a more attractive balance of risk and reward.

Disclosure:: CapitalAeon publishes independent research and commentary for informational purposes only. Past performance is no guarantee of future results. Nothing in this article should be interpreted as a recommendation or advice tailored to any particular investor. CapitalAeon may hold positions in securities mentioned here, and any such holdings are disclosed for transparency only. CapitalAeon is not a licensed securities dealer, broker, investment adviser, or investment bank. Readers should do their own research or consult a licensed professional before making investment decisions.